is there real estate transfer tax in florida

The average property tax rate in Florida is 083. Regardless of the name the.

What Are Real Estate Transfer Taxes Bankrate

The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every.

. Each county sets its own tax rate. For the purposes of determining. This tax is normally paid at closing to the Clerk of.

Since there is no other consideration for the transfer. The documentary stamp tax on a 150000 home would equal. In Florida transfer tax is called a documentary.

If the property is within Miami-Dade county the transfer tax is 06 of the sale price. Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance.

Call The Law Office Of Richard S. The Florida documentary stamp tax is a real estate transfer tax. If passed this new transfer tax would be 20 for amounts over 2.

And Mortgages and written obligations to pay money such as promissory notes. The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000. In all counties except Miami-Dade County the Florida documentary stamp tax rate is 070 per 100 paid for the property.

There are also special tax districts such as schools and water management districts that. In Florida there are two distinct transfer tax rates. The state of Florida commonly refers to transfer tax as documentary stamp tax.

This tax is normally paid at closing to the Clerk of. For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of. Documents that transfer an interest in Florida real property such as deeds.

The state of Florida commonly refers to transfer tax as documentary stamp tax. Does Florida have real estate transfer tax. Tax is paid to the Clerk of Court.

The consideration is rounded up to the nearest increment of 100. In all Florida counties other than Miami-Dade County the stamp tax owed is 70 per 100 or a rate of 07. Does Florida have real estate transfer tax.

These taxes are referred to as a transfer tax recording tax deed recording tax mortgage recording tax mortgage tax or documentary stamp tax. The rate is equal to 70 cents per 100 of the deeds consideration.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Real Estate Transfer Tax Paid For Bj S Wholesale Club Property Sale Albany Business Review

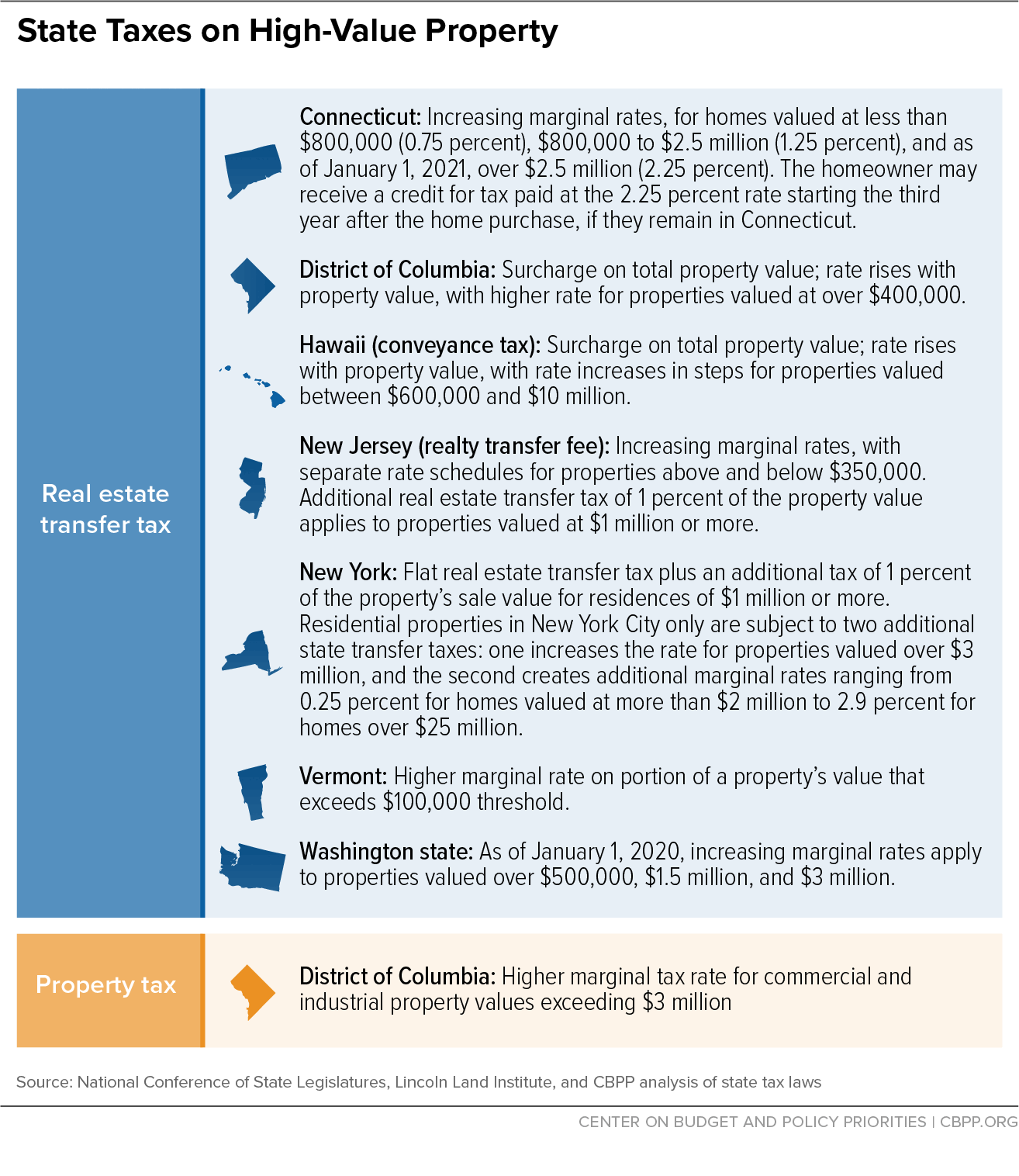

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Florida Real Estate Law And Practice Explained All Florida School Of Real Estate Florida Real Estate Mastery Kemper Pamela S Raney Heather L Kemper Jeffrey V 9781535442503 Amazon Com Books

Transfer Fee Evidence Local Option For Housing Affordability

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

Calculating The State Transfer Taxes Oneblue Real Estate School Florida Real Estate Classes

Florida Property Tax H R Block

Sales Taxes In The United States Wikipedia

Real Property Transfer Taxes In Florida Asr Law Firm

Property Taxes Brevard County Tax Collector

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Property Tax Calculator Estimator For Real Estate And Homes

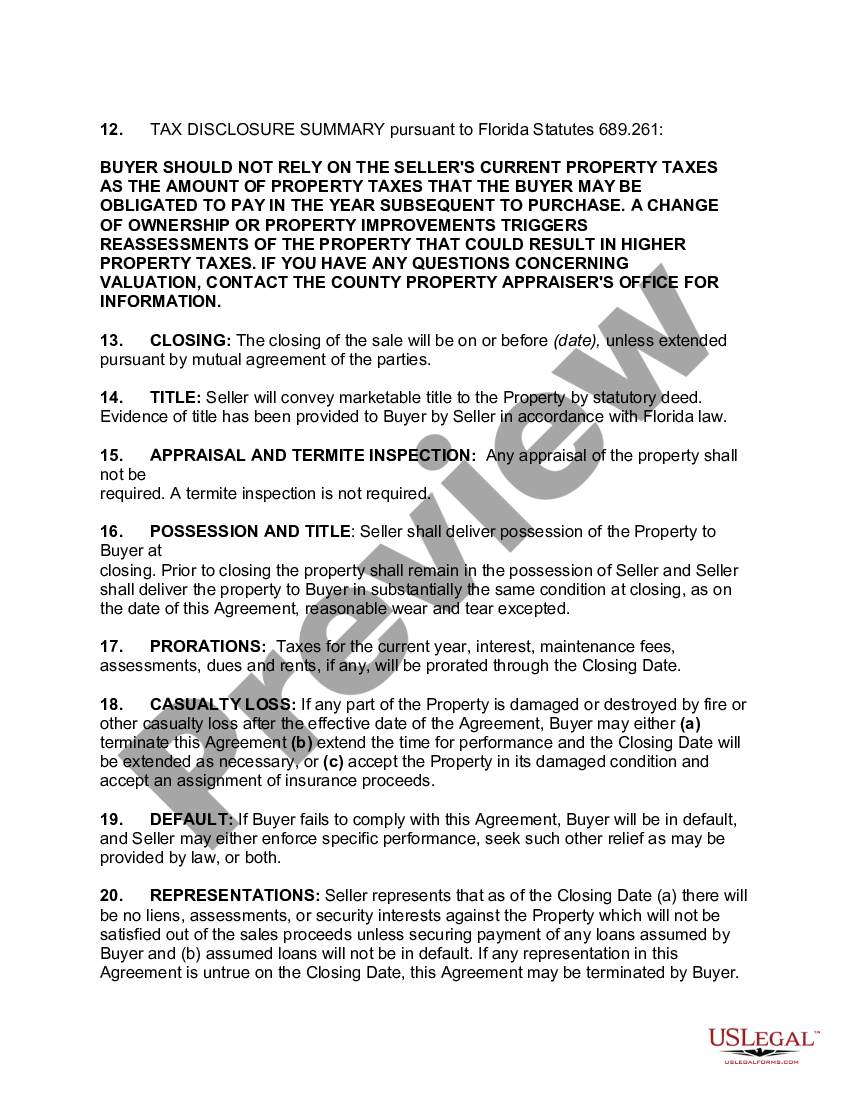

Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner Florida Purchase Sale Real Estate Us Legal Forms

Selling Property In Florida As A Non Resident