hotel tax calculator nc

Only In Your State. 10 or more but less than 20.

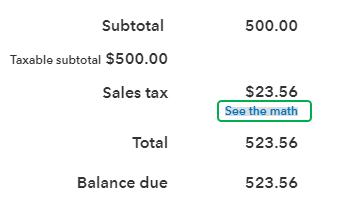

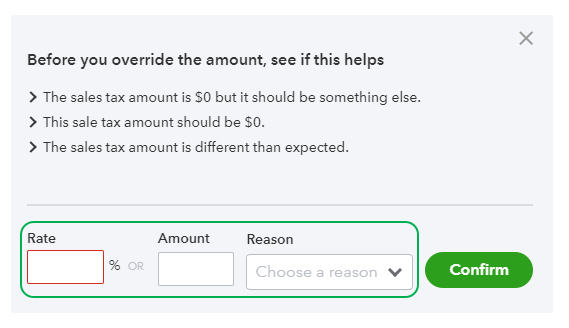

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

So if the room costs 169.

. North Carolina Salary Tax Calculator for the Tax Year 202223 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202223. 1 State lodging tax rate raised to 50 in mountain lakes area. Answer 1 of 2.

Overview of North Carolina Taxes. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. No additional local tax on accommodations. The North Carolina sales tax rate is currently.

North Carolina use tax is due if you purchased leased or rented items inside or outside this State for storage use or consumption in North Carolina and did not pay the. Gross receipts derived from the rental of an accommodation and the sales and use tax thereon are to be reported to the Department on Form E-500. It is my understanding that in Raleigh lodging rooms are taxed at 135 475 state sales tax 225 county sales tax 6 county occupancy tax.

65 100 0065. Divide tax percentage by 100. North Carolina Gas Tax.

This is the total of state county and city sales tax rates. 100 per day per room the hotel room. Multiply price by decimal.

North Carolinas property tax rates are relatively low in comparison to those of other states. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it.

The price of the coffee maker is 70 and your state sales tax is 65. The base state sales tax rate in North Carolina is 475. Currently the hotel tax adds 6 to the 7 sales tax for a total of 13 for each night visitors spend in a hotel in the county.

50 rows 125. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Im not sure about that particular hotel but the last time I stayed in Raleigh in November 10 I had to pay NC sales tax.

Rentals of Hotel Rooms and. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Wake County Tax Administration.

Room Occupancy Tax Division. 20 or more but less than 30. With local taxes the total sales tax rate is between 6750 and 7500.

For assistance in completing an. List price is 90 and tax percentage is 65. The minimum combined 2022 sales tax rate for Greensboro North Carolina is.

NA tax not levied on accommodations. North Carolina NC Sales Tax Rates by City S The state sales tax rate in North Carolina is 4750. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill.

50 cents per day per room the hotel room occupancy tax rate. The tax will be. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies.

Completed applications should be mailed to. Of that 6 15 funds the Tourism Product. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

North Carolina Property Tax Calculator.

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

Arizona Sales Tax Small Business Guide Truic

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax

Work Safety Checklist View And Print Pdf Document

Momaday And Brown Essay In 2021 Essay Essay Writing Essay Writing Tips

Latest Insurance Tax Changes In Poland France And Alberta

Rent Subsidized Apartments For Low Income Families

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Wix Stores About Tax Collection Help Center Wix Com

Collect Taxes In Checkout Stripe Documentation

Drury Inn Suites Kansas City Overland Park Overland Park Drury Inn Hotel Exterior

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Income Tax